Flood Relief

As of August 3, 2023, the State of Vermont Agency of Commerce and Community Development has opened its Business Emergency Grant Assistance Program (BEGAP).

BEGAP is specifically structured to provide up to 20% or $20,000 towards the physical losses of a business that intends to reopen following the historic flooding of July 2023.

More information available at ACCD.Vermont.gov.

Business Emergency Grant Assistance Program

Your business is eligible if the following conditions are met:

The business was established before July 7, 2023.

The physical property damage is located in Vermont.

The location for business operations and/or the business assets must have suffered physical damages from the July 2023 flood.

The business intends to reopen in the same location or elsewhere in Vermont and will utilize the grant funds for this purpose.

Your award is calculated according to your business’ net-uncovered damages:

“Net-uncovered damages” refers to the damage amount remaining after subtracting any insurance proceeds (estimated or received) and other grants or donations to be used to defray the costs of repairing or replacing those damaged assets.

For applicants who have less than $1,000,000 in net uncovered damages the award will amount to the lesser of 20% of net uncovered damage or $20,000.

For applicants who have net uncovered damages in excess of $1,000,000:

Award is calculated as the lesser of 20% of net uncovered damages or

$100,000 if applicant employs between 1 and 10 full-time employees (FTEs)

$250,000 if applicant employs between 11 and 50 FTEs

$500,000 if applicant employs over 50 FTEs.

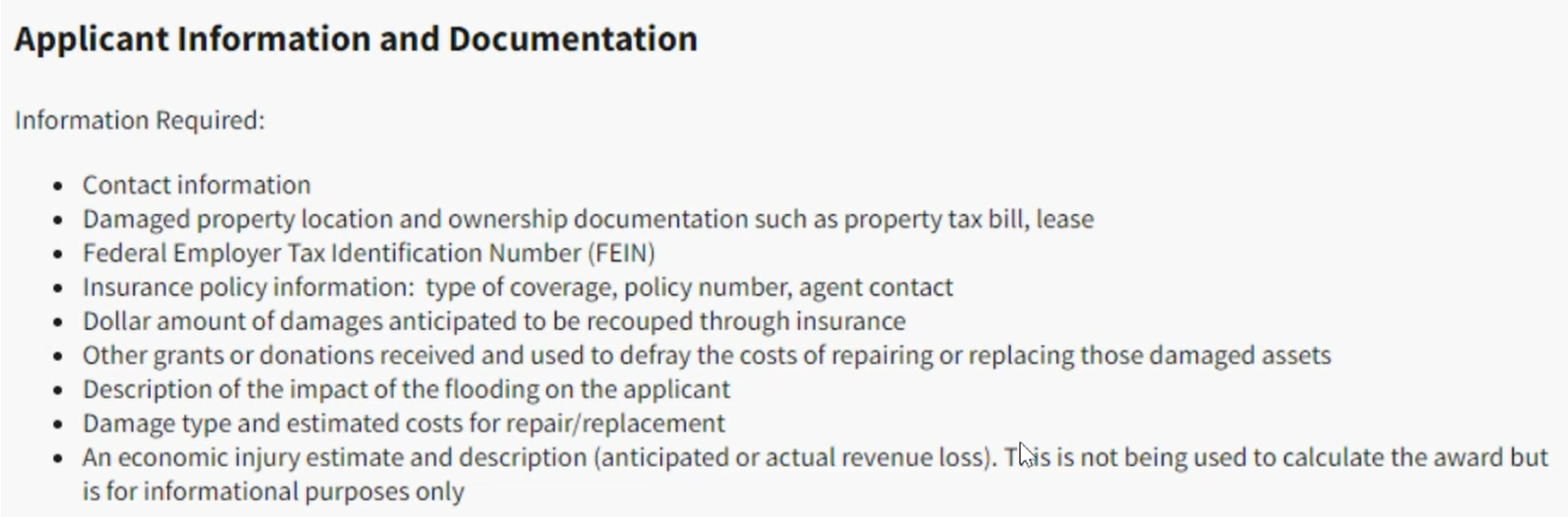

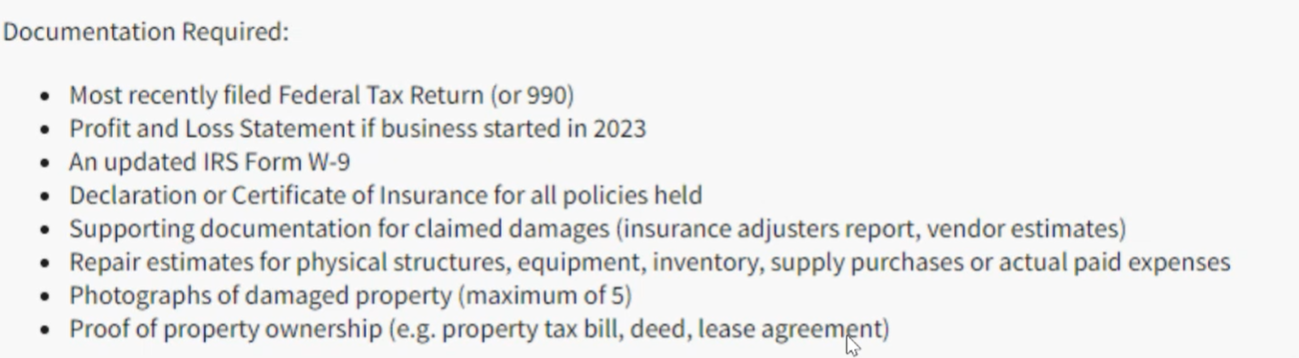

In addition to the required documents and information listed below, please have estimates of replacements costs prepared before beginning your application:

BEGAP Frequently Asked Questions

-

Q: Are landlords eligible?

A: Yes, commercial and residential landlords are eligible.

Q: Are home-based businesses eligible?

A: Damages to business assets are eligible. Damage to the home is not.

Q: Are businesses eligible that closed temporarily from the flood but have since reopened?

A: Yes.

Q: Are houses of worship eligible?

A: Yes.

Q: Is this grant funding available for individuals?

A: No, BEGAP grants are for businesses and nonprofits only.

-

Q: Which "business type” do I choose if my business fits into more than one category?

A: If your business falls into more than one sector category, please choose the one that your business operates the majority of the time.

Q: Is this grant for farms and agricultural businesses?

A: Yes, but if you are an agricultural business, please visit the Agency of Agriculture, Food and Markets (AAFM) web site for guidance before applying. If agricultural businesses have questions they can email: agr.floodresponse@vermont.gov.

Q: What if I am a sole proprietor/a landlord and don’t have an FEIN?

A: If you are a sole proprietor you will be prompted in the application to give your social security number (SSN) rather than an FEIN.

-

Q: Which types of insurance should I list?

A: List all relevant types of insurance

Q: How recent does a W-9 need to be?

A: We will need a W-9 that has been signed within the last 6 months. An e-signature will not suffice; the form requires a wet signature to be valid for the purposes of the application.

Q: What if I haven’t heard back from my insurance adjuster?

A: Please upload the insurance documents and details that you do have and also indicate in the application when prompted whether you have specific flood coverage or not.

Q: What kind of documentation should I use to demonstrate proof of ownership?

A: Proof of ownership can be shown via a property tax bill, deed, or lease.

Q: Do I need to report all grants and donations my organization already received?

A: Because this grant program is to be used to restore or reopen your business, you will need to list the funds received for the same purpose.

Q: If economic injury is not being used to calculate a BEGAP grant award, why are you asking for it?

A: We are not reimbursing for economic injury and harm at this time, but we are collecting the information to aggregate data regarding overall impact.

Q: How do I calculate economic injury?

A: At this time we are asking for what your losses are, separate from the physical damage. For example: if your business is closed, what is the estimated monetary value you are losing in revenue each day? Of note: the Small Business Administration (SBA) defines economic injury as the amount of funds you need to stay current on all of your current obligations.

Q: I am a business with multiple physical locations.

A: Businesses with multiple physical locations will need to fill out an application for each location, with a maximum of up to 3 grants per business.

Q: I am a business with multiple locations, how do I indicate FTEs?

A: Please indicate the number of FTEs at each physical location, rather than number of FTEs for the entire business.

Q: Can seasonal and/or part-time workers be considered FTEs?

A: Yes, they can be added up to determine your number of employees. One FTE is equal to 35 hours per week.

-

Q: How much money is reserved for agricultural relief?

A: Of the $20 million appropriated for business relief, $1 million is reserved for agriculture.

Q: What if my farm is a sole-proprietor and I don’t have an EIN?

A: Use your SSN.

Q: What if my crops are damaged, but still alive?

A: Damaged crops that are still alive are not eligible for relief.

Report your damage to the Agency of Agriculture here.

For further information regarding agricultural assistance, contact Abbey Willard.

-

Q: Do the documents I upload need to be in a certain format?

A: Yes, they need to be one of the following formats: .pdf, .png, or .jpg. They system does not accept documents created in Word (.doc or .docx).

Q: Is there a limit to the size of a document I can upload?

A: Yes, each document can be no larger than 10 megabytes.

Q: Is there a deadline to apply?

A: No, grant applications are first-come, first-served on a rolling basis until the funds are expended. It is imperative you submit a complete application. An incomplete application will prolong processing time.

Q: Is a BEGAP award taxable?

A: Yes.

Q: What happens if a business or nonprofit is awarded a grant and ultimately isn’t able to reopen?

A: We are sensitive to the fact that for some businesses the concept of reopening is fluid, however, we are asking that only businesses that have a solid plan to reopen apply. This guarantees that funding is available for those that need it the most.

Q: How long will it take for businesses to get grant payments?

A: We estimate approximately 7-10 days from completion of review of the application until disbursement of funds.

Q: I need help applying. What should I do?

A: There is robust technical assistance available for those who need additional help. CVEDC is available to help at 89 Main St, Montpelier. You may also reach out to the Vermont Small Business Development Center.

Q: I have more questions. Who can I ask?

A: Ask the BEGAP team by sending an email to ACCD.BizFloodGrant@Vermont.gov